The tech industry thrives on movement. Whether you’re pivoting from a startup, transitioning from permanent roles to lucrative contract positions, or climbing the ladder through strategic job changes every few years, your tech career trajectory likely resembles a dynamic upward spiral rather than the more traditional linear path.

This mobility, while excellent for skill development and salary progression, creates an often-overlooked financial challenge: a scattered collection of pension pots trailing in your wake.

The gender pension gap is one of the most pressing financial challenges facing women today, with research suggesting that women typically retire with pension pots worth half that of their male counterparts. This gap stems from various factors including lower lifetime earnings, career breaks, and part-time working, but inefficient pension management compounds the problem.

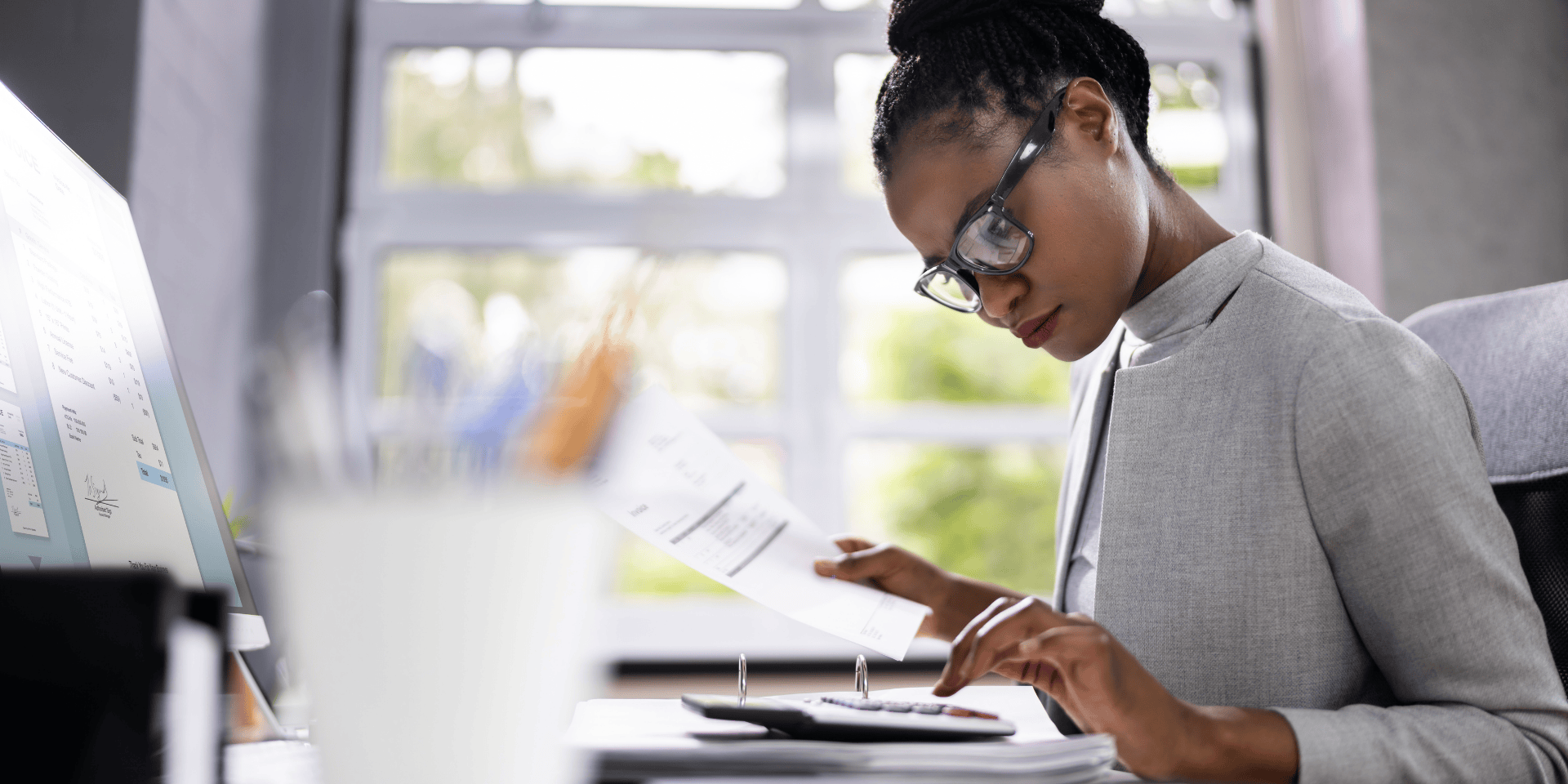

The problems multiply quickly. Small pension pots often attract disproportionately high annual management charges, eating away at your retirement savings slowly. Tracking multiple statements, login credentials, and performance across different platforms also becomes increasingly complex as your collection grows.

Combining your pensions is an effective solution to many of these challenges. It helps you to reduce unnecessary fees, simplify the management of your retirement fund, and potentially access better investment options.

Identify your current pension setup

Before embarking on consolidation, you need to carry out a comprehensive audit of your existing pensions. While sometimes time-consuming, this initial detective work forms the foundation of your consolidation strategy and will help you make informed decisions about which pensions to combine, and which might be better left alone.

Begin by making a list of each employer you’ve had, including any contract work or internships that might have included pension contributions. Many people overlook short-term positions or assume they weren’t enrolled in a pension scheme, but automatic enrolments mean that most people will be included within a few weeks of starting a new role, so it’s worth checking.

The "why": benefits for tech professionals

Consolidation provides complete clarity about your retirement situation, no matter where you are in your career. This comprehensive view makes it easier to assess whether you’re on track for your retirement goals, identify gaps in your planning, and make informed decisions about additional contributions or investment changes.

Investment control is another significant advantage, since larger pension pots often qualify for premium investment platforms with access to institutional-grade funds, lower-cost index tracking options, and sophisticated portfolio construction tools. Some providers reserve their best investment options for customers with larger account balances, meaning consolidation could unlock investment opportunities that weren’t available when your pension wealth was scattered across multiple small accounts.

Perhaps most importantly, consolidation dramatically reduces the risk of losing track of pension benefits entirely. Every year, billions of pounds in pension benefits go unclaimed because people lose contact with former schemes after changing jobs and addresses.

Special considerations for women in tech

Women in the tech industry face unique challenges when it comes to their pension that make proactive approaches particularly important. The most common is career breaks for childcare or other family responsibilities that can create significant gaps in pension contributions during your prime earning years.

While statutory maternity pay periods typically include employer pension contributions, unpaid leave or reduced hours can substantially impact long-term pension accumulation. Consolidation helps to maximise the growth potential of your existing pension savings during these periods by minimising fees and optimising any investment strategies you may have.

The rapid salary progression typical in tech careers also creates potential challenges for pension planning. While higher salaries enable larger pension contributions, frequent job changes can result in a complex web of pension arrangements that becomes increasingly difficult to manage effectively.

If you’re early on in your career, getting into the routine of consolidating straight away when you start a new role can help establish good habits and will create a solid foundation for future pension contributions.

The "how" of consolidation

Start by determining where your combined pensions will sit. This deserves careful thought because it governs your investment options, fees, and service quality—potentially for decades to come.

Ethical considerations matter to many tech professionals, so be sure to investigate providers’ approaches to environmental, social, and governance (ESG) investing if ethical investing is important to you. Some providers offer dedicated sustainable investment options, while others integrate ESG factors across their entire fund range.

Next, you can start the pension transfer through your chosen provider. Most pension providers will handle this for you, but you’ll need to provide details of your existing pensions including provider information and policy numbers that you gathered previously.

It can take anywhere from 2-4 weeks for the transfer to be completed, although more complex transfers will likely take longer than this. Timings will also depend heavily on your existing providers and how quickly they act. Once completed, regularly monitor your pension’s performance and make adjustments as needed to ensure you’re on track to meet your retirement goals.

Things to watch out for

Exit fees are one potential pitfall when it comes to combining your pensions. Some older pension schemes impose substantial charges for transferring benefits elsewhere, particularly if your pension pot has been in place for just a few years. These fees can occasionally exceed the value of small pension pots, in which case it may make more sense to leave it separate.

Be sure to check the fine print for defined benefit schemes which offer guaranteed retirement incomes based on your salary and length of service. While it’s sometimes possible to transfer the value of these benefits to a defined contribution scheme, doing so might mean giving up guarantees that could be worth significantly more than the transfer value, particularly for younger members.

Taking control of your pension and your retirement, however far off that might be for you, creates valuable foundations for your money and helps you make strategic decisions that will benefit all aspects of your finances. For women who may have less confidence in financial decision-making, learning how to successfully manage your pensions can be an empowering step toward broader financial independence.

Dakota Murphey

Dakota Murphey is an experienced freelance writer, who specialises in business and lifestyle topics ranging from digital trends to photography, sustainability and travel. She regularly contributes her insights and knowledge to a variety of digital publications.